Skip to content

Planned Giving for Financial Advisors

Mineral Interests

How they work

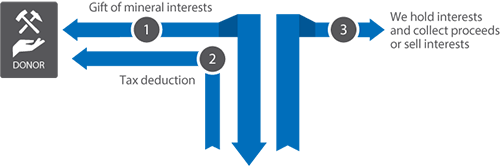

- Your client donates non-operating mineral interests to Harper College Educational Foundation.

- We hold the interest and collect the proceeds, or we sell it and apply the proceeds to the purposes your client designates.

Benefits for your client

- Your client makes a gift that benefits Harper College Educational Foundation.

- She makes the gift outright or uses it to create a life income gift that will pay her or her beneficiaries income for life.

- She is eligible to claim a tax deduction based on the mineral interest's fair-market value at the time of the gift.

- The value of the assets will be removed from her taxable estate.

In This Section